Gold is traditionally considered a safe-haven asset, but many trading approaches fail to deliver reliable returns. Its performance is heavily influenced by U.S. monetary policy, liquidity cycles, and the interaction with equity markets, making simple “buy and hold” strategies less effective.

The Disconnect Between Gold and the Stock Market

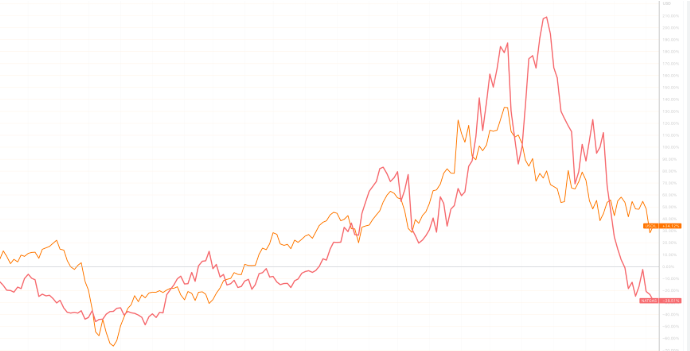

Historically, gold has moved inversely to major equity indices during market stress. However, there are periods when it lags or declines alongside stocks. For example, in early 2023, gold prices were muted despite inflation concerns, as capital flowed into growth stocks such as NVIDIA (NVDA) and Tesla (TSLA).

According to the World Gold Council, the U.S. market is increasingly driven by institutional ETFs rather than physical bullion, making prices more sensitive to Federal Reserve actions than traditional safe-haven demand.

Common Pitfalls of Gold Trading Approaches

- Inflation-Only Assumptions: Many strategies assume gold rises automatically with inflation. Rising Treasury yields in 2022–2023 made bonds more attractive, limiting gold’s gains.

- Ignoring Policy Shifts: Rate hikes or quantitative tightening often depress gold prices, yet some traders fail to account for this.

- Currency Oversights: U.S. dollar strength can pressure gold, a factor often overlooked in simplistic models (Investopedia).

A More Effective Approach: Combining Gold and Equities

The most reliable strategy integrates gold positions with select equity holdings and ETFs. Instead of relying solely on gold for protection, combining it with high-growth stocks can enhance portfolio performance.

Illustrative Examples:

- NVIDIA (NVDA): Surged due to AI adoption, offsetting periods of weak gold performance.

- Barrick Gold (GOLD): Large-cap miner, providing direct leverage to gold movements and dividend income.

- SPDR Gold Shares (GLD): Highly liquid ETF, efficient for portfolio adjustments without physical delivery.

- Tesla (TSLA): Often used by traders to capture market momentum alongside gold exposure.

This combination allows gold to act as a stabilizer while equities provide growth potential.

2025 Market Outlook

Potential Federal Reserve rate cuts and slower global growth may lift gold prices above $2,300 per ounce. Yet gold is expected to trade in cycles rather than a straight upward trend. Combining gold ETFs with short-term trades in NextEra Energy (NEE) and Moderna (MRNA) can enhance resilience and return potential.

As noted by CNBC, gold should be treated as a tactical component within a broader investment strategy rather than a perpetual hedge.

Conclusion

Many gold trading methods fail because they rely on outdated assumptions about market behavior. A balanced approach that combines gold with selective equities has proven more effective in capturing opportunities while mitigating risk. By analyzing macroeconomic factors alongside market-specific equities, investors can build a strategy aligned with real market dynamics.