(Free to join — no spam, no hype, just daily discussions and real setups.)

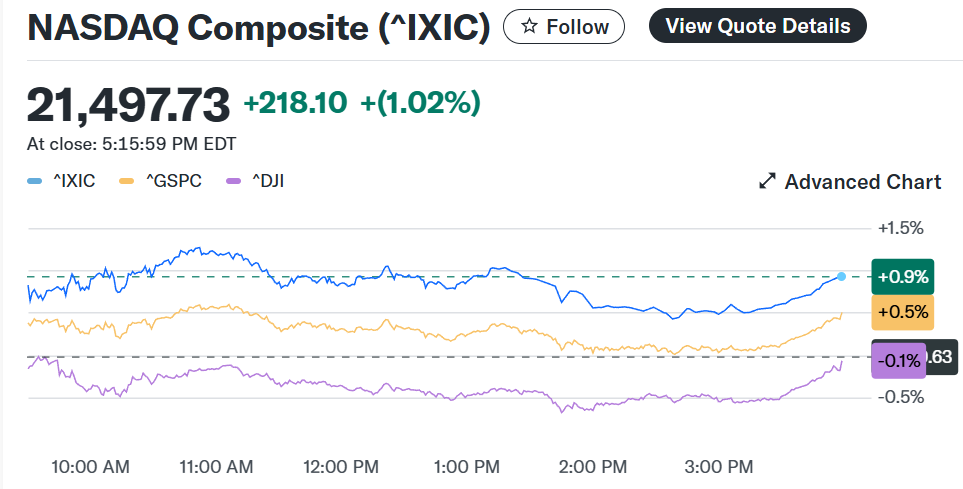

In today’s trading session, the Nasdaq Composite rose by 0.9%, and the S&P 500 increased by nearly 0.5%. The primary driver was Alphabet Inc. (GOOG), which surged after a favorable antitrust ruling allowed Google to maintain its dominance in the Chrome browser market. (finance.yahoo.com)

Conversely, the Dow Jones Industrial Average slipped due to weaker-than-expected JOLTS (Job Openings and Labor Turnover Survey) data. The report showed job openings fell to 7.18 million in July, below the anticipated 7.38 million, signaling a potential slowdown in the labor market. (uk.finance.yahoo.com)

Understanding JOLTS Data and Its Market Implications

The JOLTS report provides insights into labor market dynamics, including job openings, hires, and separations. A decline in job openings may indicate reduced business confidence and potential economic cooling. Investors often interpret this data as an indicator of future economic growth or contraction, influencing market sentiment and investment strategies.

Top Stocks to Watch in 2025 and Their Advantages

- Alphabet Inc. (GOOG/GOOGL)

Google’s leadership in search and advertising, combined with Chrome’s dominant market share, provides stable growth potential. Its cloud computing and AI businesses continue to expand, offering long-term investment advantages. (finance.yahoo.com) - Tesla Inc. (TSLA)

Tesla leads the electric vehicle industry with strong brand recognition and technological innovation. With expanding EV markets and supportive policies, Tesla has significant long-term growth potential. (finance.yahoo.com) - NVIDIA Corp. (NVDA)

NVIDIA is a global leader in GPUs and AI chips. With the rapid adoption of AI and growing data center demand, NVIDIA presents strong growth prospects, making it a top tech stock choice. (finance.yahoo.com) - Microsoft Corp. (MSFT)

Microsoft’s software, cloud computing, and enterprise services provide stable cash flow and long-term growth. Azure cloud service expansion offers additional investment opportunities. (finance.yahoo.com) - Apple Inc. (AAPL)

Apple’s diversified revenue streams from iPhone, Mac, services, and wearables maintain its market competitiveness. Brand loyalty and continuous innovation ensure long-term stability and growth. (finance.yahoo.com)

Current Market Trends and Outlook

Recent market fluctuations highlight the significant impact of tech stocks on broader indices. While Nasdaq and S&P 500 benefit from strong performances of Google, Microsoft, and NVIDIA, the Dow’s sensitivity to economic data reminds investors to monitor macroeconomic indicators. Investment strategies in 2025 should balance optimism in the tech sector with broader economic signals.