(Free to join — no spam, no hype, just daily discussions and real setups.)

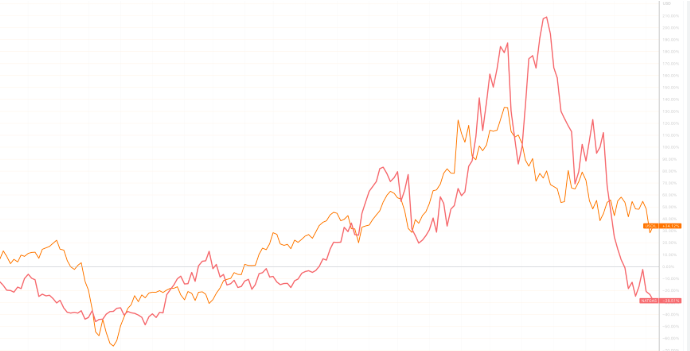

The Federal Reserve’s signals of potential interest rate cuts are creating ripples across both commodities and equities markets. While gold has surged to record levels amid expectations of lower borrowing costs, these rate cuts also present strategic opportunities for stock investors in 2025. Understanding how different assets respond to monetary policy is crucial for building a resilient investment portfolio.

Gold’s Historic Rally and Its Drivers

Gold prices have soared in response to anticipated Fed rate cuts. Historically, lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, while a weaker U.S. dollar further supports bullion prices (kitco.com). For investors seeking a hedge against inflation and market volatility, gold remains a vital part of any diversified portfolio.

How Rate Cuts Affect Stocks

Lower rates don’t just boost gold—they can also reshape equity markets. Key sectors likely to benefit include:

- Technology: AI, cloud computing, and semiconductor firms often experience accelerated growth as companies invest more in innovation.

- Consumer Discretionary: Lower borrowing costs can fuel spending in retail, automotive, and leisure industries.

- Financials: Banks and financial institutions may see improved margins as interest rates decrease.

Investors may consider sector-specific ETFs to gain diversified exposure while limiting single-stock risk (globalxetfs.com).

Integrating Gold with Stock Investments

Strategically combining gold with equities can optimize risk-adjusted returns. A balanced portfolio may include:

- Gold ETFs or physical gold exposure to capture potential upside in bullion.

- Broad-market ETFs tracking the S&P 500 for diversified equity exposure.

- Sector-focused ETFs in technology, consumer discretionary, and financials.

- International ETFs to diversify beyond the U.S. market (blackrock.com).

This approach helps investors navigate volatility while capitalizing on both precious metals and high-growth sectors.

Additional Market Perspectives

- Emerging Market Exposure: Countries with higher growth potential may outperform when U.S. rates drop, benefiting international ETFs (globalxetfs.com).

- Inflation Hedging: Gold’s performance can provide insurance against unexpected inflation spikes.

- Timing Considerations: Monitoring Fed announcements and market sentiment is critical to optimizing entry points for both gold and stocks.

Conclusion

The looming Fed rate cuts create a dual opportunity: a record-setting gold rally and potential stock market gains. By understanding these dynamics, integrating gold with equities, and maintaining a diversified, sector-aware portfolio, investors can position themselves for growth and risk mitigation in 2025.